Future Value of an Annuity Calculator

Calculate the future value of an annuity by entering the payment, term, rate, and type of annuity in the calculator below.

Future Value:

On this page:

How to Calculate the Future Value of an Annuity

Annuities are a great option for people hoping to create sustainable cash flows in the future, and using a future value of annuity calculator is an efficient and easy way to determine the value of an annuity over time.

An annuity is a fixed sum of money that will be paid to a person or party in the future at regular intervals. In most cases, an annuity will be paid annually to the intended party for the rest of their life.

The payment schedule, payment amount, and most other variables will be determined in advance, which means that people who receive annuity payments will be particularly vulnerable to the effects of inflation.

Determining the future value of an annuity is critical when deciding whether to invest. In this guide, we will discuss how to calculate the future value of several of today’s most common types of annuities.

What is Future Value?

The future value of a given asset—whether an annuity or otherwise—estimates how much that asset will be worth at a certain point in the future, which is usually based on a predetermined rate of expected growth.

When calculating the future value of an annuity, it is important to remember the time value of money (TVM): when all else is equal, money will be worth more today than it will be worth in the future.

Would you rather have $10,000 today or receive $1,000 per year for the next 12 years? The answer is not always obvious. While the first choice gets you your money sooner, the second choice will end up giving you more money over time.

The lost opportunity cost of investing money today, interest rates, and inflation can all impact the value of future money, which is why understanding the time value of money is so important; without considering it, it is impossible to determine which scenario is actually better.

Keeping this in mind, what are some of the most common types of annuities you might encounter?

Types of Annuities

There are many different types of annuities, but all annuities offer a greater, time-value-adjusted future payout in exchange for “paying in” early, whether partially or all at once. These payouts are made on an annual basis, which makes them excellent planning tools when you are considering future unknowns, such as the length of your retirement.

Most annuities can be classified in one of four possible categories: immediate fixed annuities, immediate variable annuities, deferred fixed annuities, and deferred variable annuities. Let’s take a quick look at what makes each of these annuity categories unique:

Immediate Fixed Annuities

These annuities involve making a large lump sum payment and immediately gaining access to an annual payout for the rest of your life. These annuities will give you an income right away, although they require a larger initial payment and might not keep pace with inflation.

Immediate Variable Annuities

These annuities also offer an immediate stream of income; however, the payments will be based on changing market conditions, and your annual payment may increase or decrease over time.

Deferred Fixed Annuities

This annuity plan provides you with an annual stream of income at some predetermined point in the future, and the payment amount will not fluctuate.

Deferred Variable Annuities

Payments from this type of annuity are postponed and are dependent on market conditions so may fluctuate.

Ultimately, when comparing these four categories, you should ask yourself two questions: Are you willing to wait for payment? And are you willing to test the market and risk market changes?

Now that we’ve discussed the basics of annuities, let’s look at how to calculate future value.

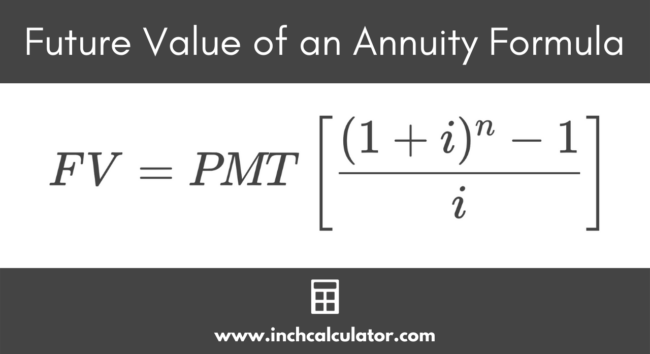

Annuity Future Value Formula

To calculate an annuity’s future value, use the following formula:

Where:

FVORD = future value of an ordinary annuity

PMT = payment amount

i = interest rate

n = number of payments

The formula above is for an “ordinary annuity,” which is an annuity that involves making payments at the end of each payment period. This makes quite a bit of difference in an annuity’s perceived value, due to the time value of money.

In this context, an “ordinary annuity” is the same as an immediate fixed annuity, meaning that the holder of the annuity will begin to immediately receive payments for the rest of their life.

If you want to figure out what the annuity might be worth over the course of ten years, use “10” in place of “n” in the formula above.

Annuity Due Future Value Formula

An annuity due is distinct from “ordinary annuities” because its payments are made at the beginning of the payment period, rather than the end. The annuity due formula is:

Where:

FVDUE = future value of an annuity due

PMT = payment amount

i = interest rate

n = number of payments

The main difference here is multiplying by “1 plus the interest rate.”

Future Value of Growing Annuities

A growing annuity is an annuity whose payments increase over time. In this case, the formula is:

Where:

FV = future value of a growing annuity

PMT = payment amount

i = interest rate

g = growth rate

n = number of payments

While the mechanics are similar, the formula is slightly more complicated.

Annuities with Continuously Compounded Interest

Continuously compounding interest will cause annuities to generate slightly more value—although this also creates some calculation challenges. When interest growth is continuous, the payment schedule relies on a logarithmic scale.

Where:

FV = future value of a continuously compounding annuity

PMT = payment amount

i = interest rate

n = number of payments

e = Euler’s Number

Calculating an annuity’s future value will help you determine if investing in one makes sense for you. While annuities can be a great retirement-planning vehicle, we recommend exploring all your available investment options.

You might also be interested in learning how to calculate the present value of an annuity.