Future Value Calculator

Calculate the future value of money given the rate of return and length of time in years using our FV calculator.

Future Value:

| Total Value: | $1,254.41

|

| Total Principal: | $1,000.00

|

| Total Interest: | $254.41

|

Balance by Year

On this page:

How to Calculate Future Value

Future value is the value of an asset or investment at some point in the future, accounting for growth over time.

You can calculate the future value of an investment using several methods of growth: simple interest or compound interest.

How to Calculate Future Value Using Simple Interest

The first method to calculate future value is with simple interest. Simple interest is not the common method, and this future value calculator does not use simple interest. However, it is still helpful to show the future value with simple interest to compare how much extra interest is earned with compound interest.

Simple Interest FV Formula

The formula to calculate future value with simple interest is:

FV = PV × (1 + (r × n))

Where:

FV = future value

PV = present value

r = interest rate

n = number of periods

For example, let’s say that you have just been given a $100,000 inheritance and plan on investing it for 30 years, at which point you will retire. You invest it in a mix of stocks and bonds and expect an average annual interest rate of 7%. What would the future value of the money be with simple interest?

FV = $100,000 × (1 + (0.07 × 30))

FV = $100,000 × (1 + 2.1)

FV = $100,000 × 3.1

FV = $310,000

You can expect to end up with $310,000 after 30 years. The principal value is $100,000 and the total interest is $210,000.

How to Calculate Future Value Using Compound Interest

The other method to calculate future value is with compound interest, and this is the method the future value calculator uses. The more times that interest is compounded per year, the more interest will be paid. The future value calculator can calculate different compounding periods.

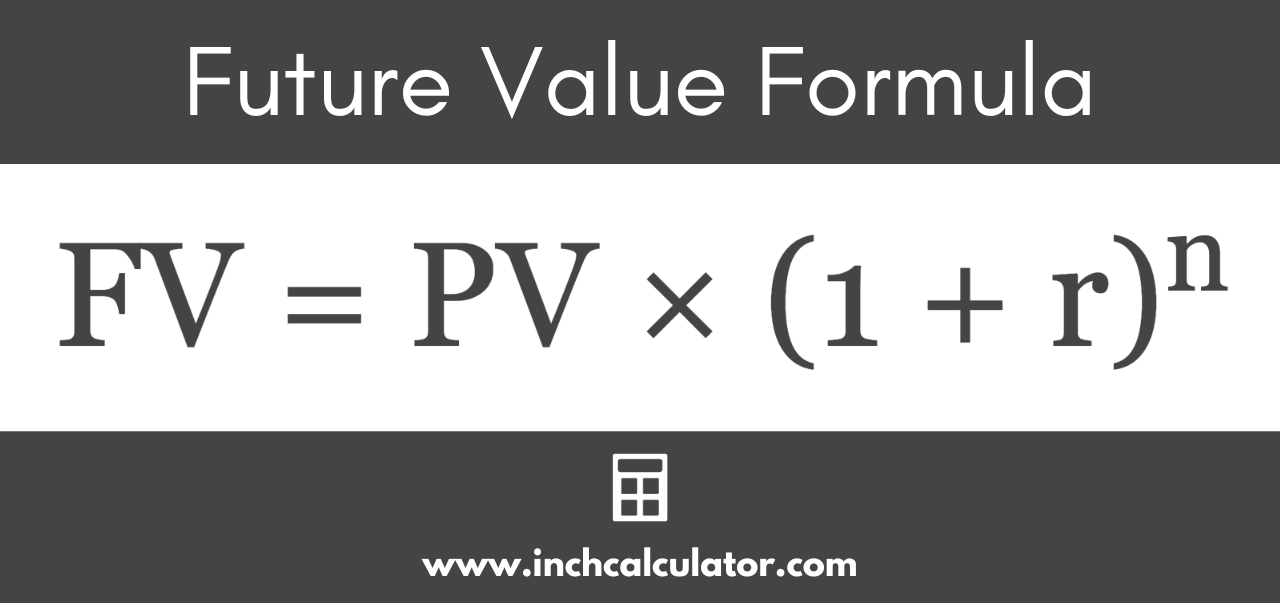

Compound Interest FV Formula

The formula to calculate future value with compound interest is:

FV = PV × (1 + r)n

Where:

FV = future value

PV = present value

r = interest rate

n = number of periods

Let’s use the same assumptions as the previous example to see how much more interest will be paid with annual compounding.

FV = $100,000 × (1 + 0.07)30

FV = $100,000 × 1.0730

FV = $100,000 × 7.612255

FV = $761,225.50

The future value calculated with compound interest is almost 2.5 times as much as the future value calculated with simple interest. This example shows the power of compounding without any additional contributions to the retirement account.

The principal value again stays the same at $100,000, but now the total interest is $661,225.50. If you enter these criteria in the future value calculator, the chart shows that the principal makes up most of the total value at the beginning, and you can see how the compounded interest quickly grows over time.

Keep in mind that not all methods of compounding are equal. Investments with interest that is compounded more frequently will grow at a faster rate (and thus have a greater FV) than those that compound less frequently.

The principal value again stays the same at $100,000, but now the total interest is $661,225.50. If you enter these criteria in the future value calculator, the chart shows that the principal makes up most of the total value at the beginning, and you can see how the compounded interest quickly grows over time.

Keep in mind that not all methods of compounding are equal. Investments with interest that is compounded more frequently will grow at a faster rate (and thus have a greater FV) than those that compound less frequently.

You might also be interested in our future value of an annuity calculator.

Frequently Asked Questions

What is future value?

Future value is the value of an investment at some point in the future. The time value of money essentially states that the value of money today is worth more than the value of money in the future.

The reason being that you can invest the money today and earn a return on that money. But if you receive the money in the future, you wouldn’t be able to invest the money between today and when it was received.

Would you prefer to receive $100 today or $100 in one year? The answer is simple: you would want to take the money today. Even if you invested it at a risk-free rate of 1%, that would give you $101 at the end of the year.

But if you could invest the $100 at a 15% interest rate, you should take the $100 today and would end up with $115 after investing it for a year after earning $15 in interest. So, in this example, the present value is $100 and the future value is $115.

Why is future value important?

Future value (and the time value of money as a whole) plays an important role in many financial decisions. Individuals use it to forecast how much they will need at retirement, businesses use it when deciding whether or not to invest in capital, and investors use it to value stocks or bonds or to calculate the return on a CD.

As the previous examples showed, the future value provides a useful way of seeing how much can be expected at retirement. While inflation was not factored into the prior examples, the future value of money can be adjusted for inflation and show the real purchasing power of the money.

Corporations also use future value and the time value of money to determine whether a specific investment makes financial sense. If a business is looking to expand and purchase a new warehouse or machinery, the time value of money will show what the best investment is or if it is best to do nothing at this time.

Lastly, investors can use the time value of money to value a specific investment using an analysis called discounted cash flow. It basically states that an investment’s value today is the present value of all future cash flows (dividends for stocks or interest payments for bonds).

The time value of money plays an important role for all individuals—if you bank, borrow, or invest, you are impacted by the time value of money.

Is future value the same as face value?

Future value is the value of an investment or asset at some point in the future, while face value, or present value, is the value of that investment or asset right now.