Boat Loan Calculator

Calculate the payment for a boat loan using our loan calculator below.

Boat Loan Summary:

| Monthly Payment: | $500.09

|

| Loan Amount: | $26,500.00

|

| Total Interest: | $3,505.26

|

| Total Payments: | $30,005.26

|

| Payoff Date: | Jul 2030

|

Amortization Schedule:

| Date | Payment | Principal | Interest | Remaining Balance |

|---|---|---|---|---|

| Jul 2025 | $500.09 | $389.67 | $110.42 | $26,110.33 |

| Aug 2025 | $500.09 | $391.30 | $108.79 | $25,719.03 |

| Sep 2025 | $500.09 | $392.93 | $107.16 | $25,326.10 |

| Oct 2025 | $500.09 | $394.56 | $105.53 | $24,931.54 |

| Nov 2025 | $500.09 | $396.21 | $103.88 | $24,535.33 |

| Dec 2025 | $500.09 | $397.86 | $102.23 | $24,137.47 |

| Jan 2026 | $500.09 | $399.52 | $100.57 | $23,737.95 |

| Feb 2026 | $500.09 | $401.18 | $98.91 | $23,336.77 |

| Mar 2026 | $500.09 | $402.85 | $97.24 | $22,933.92 |

| Apr 2026 | $500.09 | $404.53 | $95.56 | $22,529.39 |

| May 2026 | $500.09 | $406.22 | $93.87 | $22,123.17 |

| Jun 2026 | $500.09 | $407.91 | $92.18 | $21,715.26 |

| Jul 2026 | $500.09 | $409.61 | $90.48 | $21,305.65 |

| Aug 2026 | $500.09 | $411.32 | $88.77 | $20,894.33 |

| Sep 2026 | $500.09 | $413.03 | $87.06 | $20,481.30 |

| Oct 2026 | $500.09 | $414.75 | $85.34 | $20,066.55 |

| Nov 2026 | $500.09 | $416.48 | $83.61 | $19,650.07 |

| Dec 2026 | $500.09 | $418.21 | $81.88 | $19,231.86 |

| Jan 2027 | $500.09 | $419.96 | $80.13 | $18,811.90 |

| Feb 2027 | $500.09 | $421.71 | $78.38 | $18,390.19 |

| Mar 2027 | $500.09 | $423.46 | $76.63 | $17,966.73 |

| Apr 2027 | $500.09 | $425.23 | $74.86 | $17,541.50 |

| May 2027 | $500.09 | $427.00 | $73.09 | $17,114.50 |

| Jun 2027 | $500.09 | $428.78 | $71.31 | $16,685.72 |

| Jul 2027 | $500.09 | $430.57 | $69.52 | $16,255.15 |

| Aug 2027 | $500.09 | $432.36 | $67.73 | $15,822.79 |

| Sep 2027 | $500.09 | $434.16 | $65.93 | $15,388.63 |

| Oct 2027 | $500.09 | $435.97 | $64.12 | $14,952.66 |

| Nov 2027 | $500.09 | $437.79 | $62.30 | $14,514.87 |

| Dec 2027 | $500.09 | $439.61 | $60.48 | $14,075.26 |

| Jan 2028 | $500.09 | $441.44 | $58.65 | $13,633.82 |

| Feb 2028 | $500.09 | $443.28 | $56.81 | $13,190.54 |

| Mar 2028 | $500.09 | $445.13 | $54.96 | $12,745.41 |

| Apr 2028 | $500.09 | $446.98 | $53.11 | $12,298.43 |

| May 2028 | $500.09 | $448.85 | $51.24 | $11,849.58 |

| Jun 2028 | $500.09 | $450.72 | $49.37 | $11,398.86 |

| Jul 2028 | $500.09 | $452.59 | $47.50 | $10,946.27 |

| Aug 2028 | $500.09 | $454.48 | $45.61 | $10,491.79 |

| Sep 2028 | $500.09 | $456.37 | $43.72 | $10,035.42 |

| Oct 2028 | $500.09 | $458.28 | $41.81 | $9,577.14 |

| Nov 2028 | $500.09 | $460.19 | $39.90 | $9,116.95 |

| Dec 2028 | $500.09 | $462.10 | $37.99 | $8,654.85 |

| Jan 2029 | $500.09 | $464.03 | $36.06 | $8,190.82 |

| Feb 2029 | $500.09 | $465.96 | $34.13 | $7,724.86 |

| Mar 2029 | $500.09 | $467.90 | $32.19 | $7,256.96 |

| Apr 2029 | $500.09 | $469.85 | $30.24 | $6,787.11 |

| May 2029 | $500.09 | $471.81 | $28.28 | $6,315.30 |

| Jun 2029 | $500.09 | $473.78 | $26.31 | $5,841.52 |

| Jul 2029 | $500.09 | $475.75 | $24.34 | $5,365.77 |

| Aug 2029 | $500.09 | $477.73 | $22.36 | $4,888.04 |

| Sep 2029 | $500.09 | $479.72 | $20.37 | $4,408.32 |

| Oct 2029 | $500.09 | $481.72 | $18.37 | $3,926.60 |

| Nov 2029 | $500.09 | $483.73 | $16.36 | $3,442.87 |

| Dec 2029 | $500.09 | $485.74 | $14.35 | $2,957.13 |

| Jan 2030 | $500.09 | $487.77 | $12.32 | $2,469.36 |

| Feb 2030 | $500.09 | $489.80 | $10.29 | $1,979.56 |

| Mar 2030 | $500.09 | $491.84 | $8.25 | $1,487.72 |

| Apr 2030 | $500.09 | $493.89 | $6.20 | $993.83 |

| May 2030 | $500.09 | $495.95 | $4.14 | $497.88 |

| Jun 2030 | $499.95 | $497.88 | $2.07 | $0.00 |

On this page:

How to Calculate the Payment for a Boat Loan

Purchasing a boat is a significant investment, and most buyers opt to finance the purchase through a loan. Understanding how much you’ll need to pay each month helps you budget and ensures that you’re not overextending your finances.

Just like an auto or motorcycle loan, the payment for a boat loan is determined by a few key components: the loan amount, interest rate, and loan term. Understanding these factors allows you to calculate your monthly payment to ensure you can affordably enjoy your time on the water.

Step One: Determine the Loan Amount

The loan amount is the total amount of money borrowed from a lender to purchase the boat. This might include the price of the boat itself, a trailer, accessories, taxes, and loan fees. You can reduce the loan amount by making a down payment or trading in your old boat.

Step Two: Determine the Interest Rate

The interest rate is the premium charged by the lender when they borrow the money, and it’s often expressed as an annual percentage rate (APR). Interest rates can vary by lender, your credit score, and the current market conditions. If you have a higher credit score, you may qualify for a lower interest rate, and thus, lower payments.

Step Three: Determine the Loan Term

The loan term is the length of time you agree to pay the entirety of the loan back to the lender. The term is typically expressed in months and usually ranges from 24 to 60 months.

Loans with longer terms typically carry lower monthly payments but charge more interest over time.

Step Four: Calculate the Monthly Payment

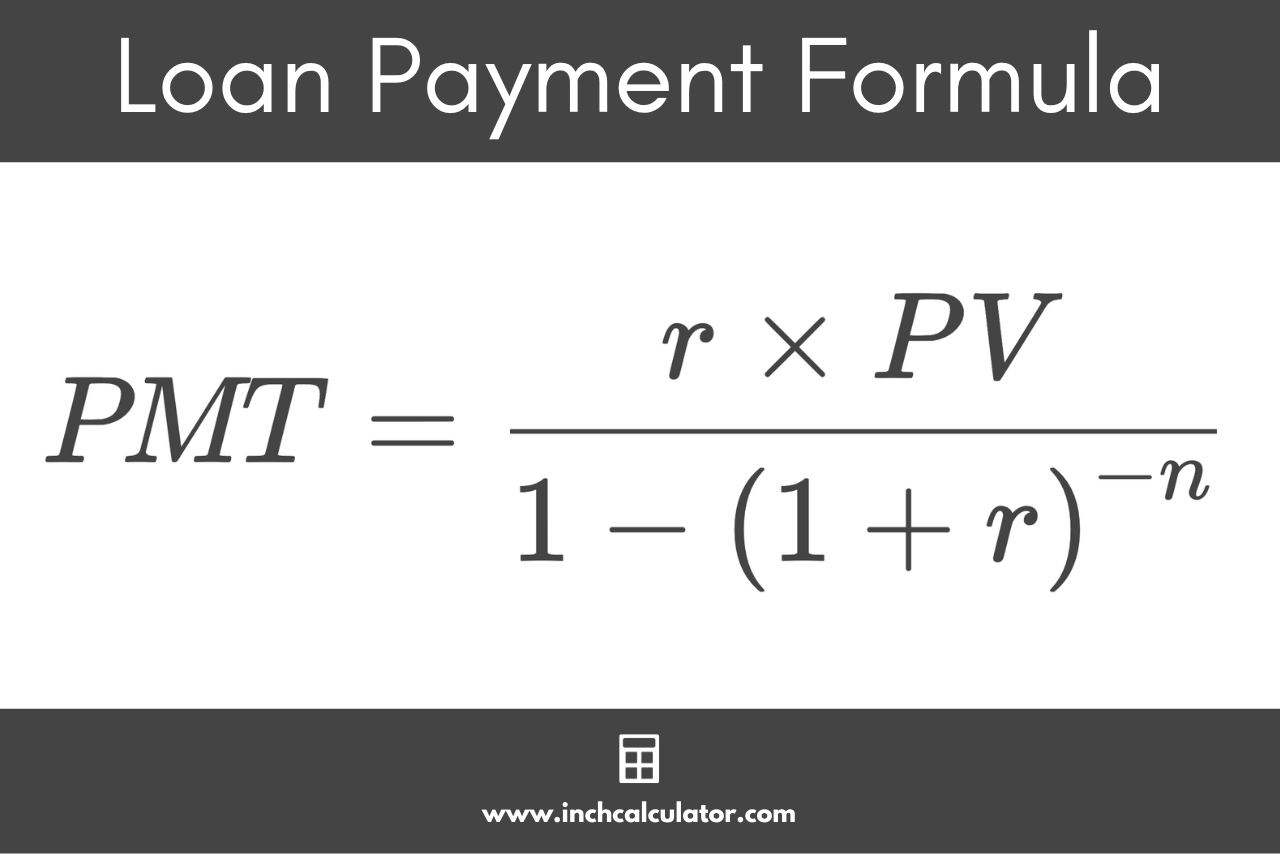

To calculate the monthly payment for a boat, you can use the formula for a loan payment:

Where:

PMT = monthly payment

PV = loan amount

r = interest rate

n = number of payments

Step Five: Account for Additional Costs

There are usually a wide variety of costs and fees associated with owning a boat. Many of these may not be included in the loan payment. These can include fuel (for powerboats), insurance, registration fees, storage costs, maintenance, repairs, a cover, a top, a trailer and its upkeep, dock or marina fees, haul-out, winterizing, safety equipment, accessories, safety courses, and your boating license.

While these may not affect the loan payment directly, they can definitely impact your overall budget and affect the total cost of owning a boat each month.

You can use this same method to calculate the loan for an RV or ATV as well.