Compound Interest Calculator

Calculate the future value of money using our compound interest calculator. Enter the present value, additional contributions (if any), interest rate, and length of time in years below.

Future Value:

| Total Value: | $1,254.41

|

| Total Principal: | $1,000.00

|

| Total Interest: | $254.41

|

Balance by Year

On this page:

- Calculator

- How to Calculate Compound Interest

- The Importance of Compounding Frequency

- Compound Interest Formulas

- Compound Interest Formula with Annual Compounding

- Compound Interest Formula for Compounding Multiple Times per Period

- Compound Interest Formula with Annual Contributions

- Continuously Compounded Interest Formula

- Examples

- How Long Does it Take to Double an Investment using Compound Interest?

- How to Calculate the Total Value After Interest

- How to Calculate Total Principal

- How to Calculate Total Interest

- Frequently Asked Questions

How to Calculate Compound Interest

Compound interest is interest that is calculated on the principal value and accumulated interest of an investment or loan. Using a tool like the compound interest calculator will provide the quickest and easiest way to calculate compound interest.

With compound interest, interest is earned on the prior interest earned and the principal balance. This differs from simple interest in that simple interest is only earned on the principal balance.

Additionally, you can enter an amount for contributions. The assumption here is that this amount is added at the end of the year, so interest won’t be earned in the year that it is added. However, if more than one year is selected, it will earn interest in future years.

Interest will be earned on contributions, leading to more exponential growth.

The Importance of Compounding Frequency

The frequency that interest is compounded can have a large effect on the growth over time. More regular compounding will result in faster growth since the growth is more exponential. This compound interest calculator gives the option for continuous, daily, monthly, quarterly, semiannually, and annually compounded interest, which are the most common and practical time intervals.

Interest can technically be compounded at any time interval you would like, but the time intervals above are most common.

The more frequent the compounding, the more interest will be paid. If you select “continuous” from the compounding dropdown in the calculator, it will yield the highest interest amount. Selecting “annually” will produce the lowest interest amount.

Annual compounding makes it easier to calculate interest by hand since the formula is a bit simpler than other forms of compounded interest.

Compound Interest Formulas

There are several formulas for calculating compound interest, depending on the compounding frequency and whether you’ll be making contributions along the way.

Compound Interest Formula with Annual Compounding

The compound interest formula in its most basic form assuming compounding once per period is:

where:

A = future value

P = present value

r = interest rate

t = number of periods

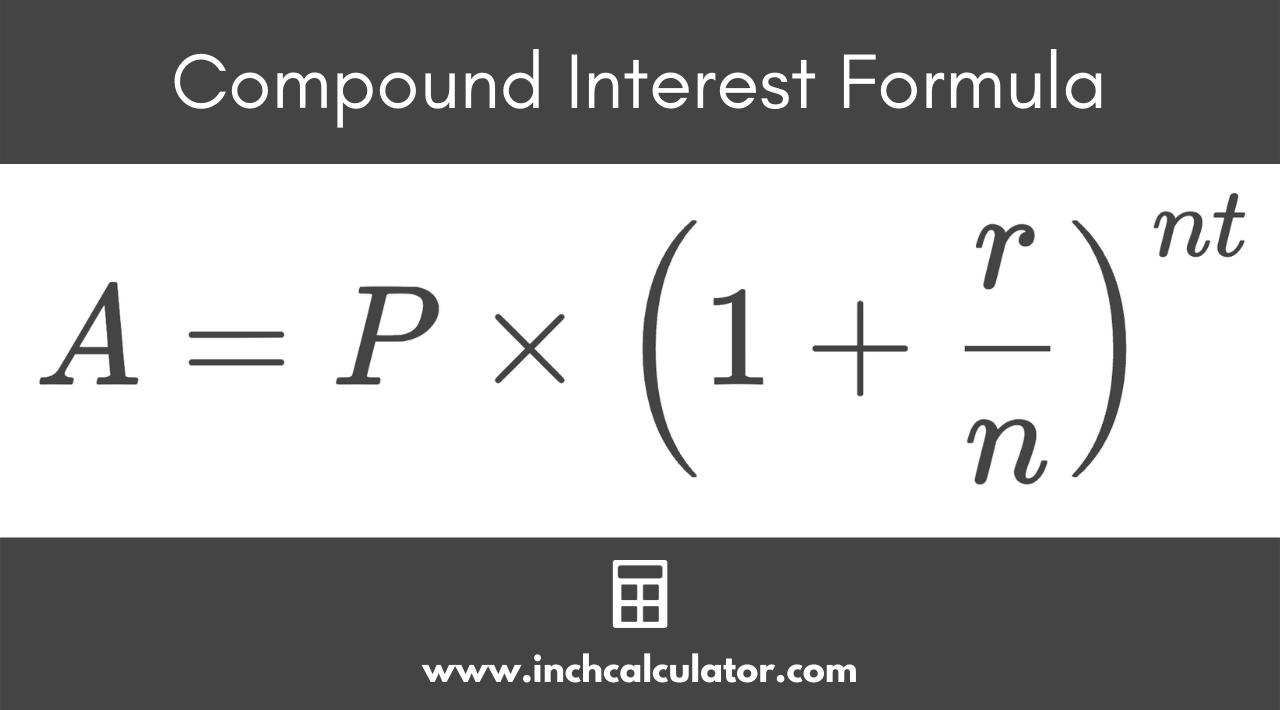

Compound Interest Formula for Compounding Multiple Times per Period

The compound interest formula for interest compounding multiple times per period and without contributions is as follows:

where:

A = future value

P = present value

r = interest rate

n = number of times interest is compounded per period

t = number of periods

Compound Interest Formula with Annual Contributions

However, if you want to add contributions at the end of each year, you would use the following formula:

where:

A = future value

P = present value

PMT = annual contribution

r = interest rate

n = number of times interest is compounded per period

t = number of periods

Continuously Compounded Interest Formula

Interest that is continuously compounded earns the most interest of all the time intervals because you are always earning interest.

The continuous compound interest formula is:

where:

A = future value

P = present value

e = Euler’s number – approximate value of 2.718281

r = interest rate

t = number of periods

Examples

We will look at a few examples: one with no contributions, one with annual contributions, and one with continuous compounding.

No Contributions

Let’s say we will invest $10,000 in a certificate of deposit for 3 years at an annual interest rate of 5% and interest will be compounded annually. (tip: you can also use our daily compound interest calculator). In this first example, we assume no contributions.

Using the second compound interest formula above, we start out with:

Annual Contributions

Now if we use the compound interest formula with a $500 annual contribution, we get:

If you compare the compound interest formulas above, you will see the second part of the formula without contributions can be substituted in place of the variable k in the formula with contributions so we don’t need to recalculate this portion of the formula.

So, while we contributed $1,500 ($500 per year for 3 years), the balance increased by $1,576.25 since we earned interest for 2 years on the first contribution and for 1 year on the second contribution.

Continuous Compounding

Using continuous compounding with the example above, we would get an amount equal to $11,618.34 as the calculation below shows. This is $42.09 higher than with annual compounding, and this value will increase over time.

How Long Does it Take to Double an Investment using Compound Interest?

If you want to find the time it will take to double an investment using compound interest then you can use the Rule of 72. The Rule of 72 provides an approximation of the time to double by dividing 72 by the annual interest rate.

For instance, it would take a little over seven years to double an investment with an annual rate of 10% (72 / 10 = 7.2).

The Rule of 72 is just an approximation, to find the exact time to double you can use our Rule of 72 calculator.

How to Calculate the Total Value After Interest

Total value is the sum of principal and interest. The total principal is the sum of the initial value plus any contributions. The total interest is the amount of interest that was earned from the investment or accrued on a loan.

The examples above show how to calculate total value mathematically. As you can see, it is much easier to use a compound interest calculator.

You can also use our APY calculator if no contributions are made or our CAGR calculator to reverse the compound interest formula and show what the compounding interest rate is if you know the ending balance.

How to Calculate Total Principal

To calculate total principal, add the initial value to the annual contribution times the number of years you contributed. If there are no contributions, then the total principal is equal to the initial value.

In our first example, the total principal was $10,000 since there were no contributions. However, the total principal in the second example was $11,500 because $1,500 in contributions were added to the beginning principal of $10,000.

How to Calculate Total Interest

Total interest is calculated by a three-step process:

- Take the annual interest rate and divide by the number of times interest is compounded in a year and then add 1.

- Raise this number to the power of the number of years times the number of times interest is compounded in a year and then subtract 1.

- Multiply this new amount by the initial value.

While things get a bit more complicated when contributions are introduced, these are the steps needed to calculate compound interest.

You can also calculate compound interest using our interest calculator, which allows you to calculate either simple or compound interest.

Frequently Asked Questions

How does compound interest work?

Compound interest works by a loan or investment earning interest on the initial value plus the prior interest earned. This means that you earn interest on prior interest, leading to exponential growth for an investment.

What are the types of compound interest?

There are two types of compound interest: periodic and continuous. Periodic compound interest is when interest is compounded at certain times, such as daily, monthly, quarterly, semiannually, or annually.

Continuous compound interest is when interest is earned continuously, at the smallest possible interval, leading to the highest form of growth for an investment or loan.

Do banks offer compound interest accounts?

Many banks do offer compound interest accounts for savings accounts, certificates of deposit (CDs), and money market accounts. Each bank may vary in the compounding frequency, be it daily, monthly, or annually.