Debt-to-Equity Ratio Calculator – D/E Formula

Calculate a debt-to-equity ratio using the calculator below. Keep reading to learn more about D/E and see the debt-to-equity ratio formula.

Debt to Equity (D/E) Ratio:

On this page:

How to Calculate Debt-to-Equity Ratio

The debt-to-equity ratio (D/E) measures the amount of liability or debt on a company’s balance sheet relative to the amount of shareholders’ equity on the balance sheet. D/E calculates the amount of leverage a company has, and the higher liabilities are relative to shareholders’ equity, the more leveraged the company is.

Debt can have its upside because it is cheaper than equity and doesn’t involve giving away a piece of the company. According to the Corporate Finance Institute, the cost of equity is generally higher than the cost of debt since investors take on more risk when purchasing a company’s stock vs. it’s bond.[1]

But, if debt gets too high, then the interest payments can be a severe burden on a company’s bottom line.

A company with a D/E ratio greater than 1 means that liabilities are greater than shareholders’ equity. A D/E ratio less than 1 means that shareholders’ equity is greater than total liabilities.

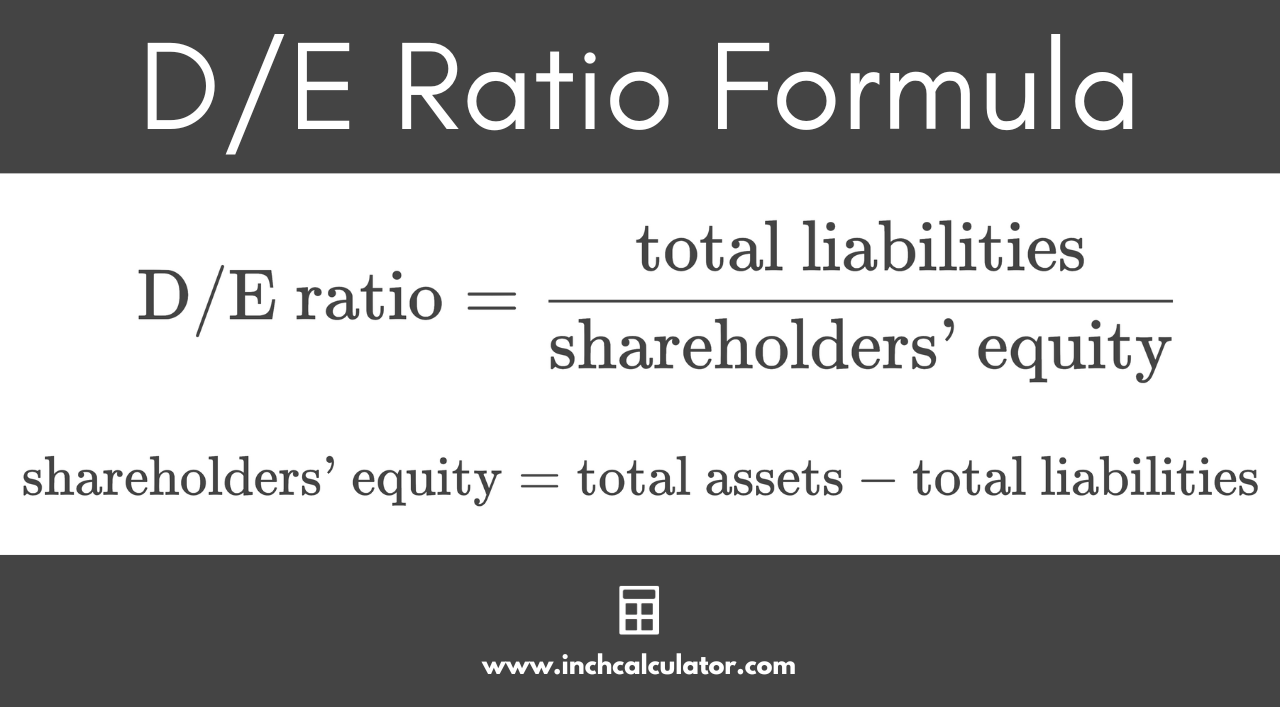

Debt-to-Equity Ratio Formula

The debt-to-equity ratio is calculated using the formula below.[2]

D/E ratio = total liabilities / shareholders’ equity

Both of these values can be found on a company’s balance sheet, which is a financial statement that details the balances for each account. The sum of liabilities and shareholders’ equity equals total assets. All assets are either financed using debt (liabilities) or equity.

total assets = total liabilities + shareholders’ equity

That is, total assets must equal liabilities + shareholders’ equity since everything that the firm owns must be purchased by either debt or equity.

We can rearrange this formula to calculate the shareholders’ equity:

shareholders’ equity = total assets – total liabilities

Thus, shareholders’ equity is equal to the total assets minus the total liabilities.

Our return on equity calculator divides net income by equity instead of dividing liabilities by equity. Net income is found on a separate financial statement: the income statement. This shows the business owners how much profit the company made during a year relative to the balance of its shareholders’ equity.

For example, let’s assume we are looking at a company’s balance sheet with total assets of $1,000,000 and liabilities of $400,000. Using these two amounts, can we solve for the debt-to-equity ratio?

We have the amount for debt, but we first need to solve for equity. We know that total liabilities plus shareholder equity equals total assets. Therefore, shareholder equity must equal $600,000.

shareholders’ equity = $1,000,000 – $400,000 = $600,000

We can now solve for the D/E ratio:

D/E ratio = $400,000 / $600,000 = 0.67

But, what would happen if the company changes something on its balance sheet? Let’s look at two examples, one in which the company adds debt and one in which the company adds equity to the balance sheet.

If a company takes out a loan for $100,000, then we would expect its D/E ratio to increase. Our company now has $500,000 in liabilities and still has $600,000 in shareholders’ equity. Total assets have increased to $1,100,000 due to the additional cash received from the loan.

In this example, the D/E ratio has increased to 0.83, which is found by dividing $500,000 by $600,000.

If, on the other hand, equity had instead increased by $100,000, then the D/E ratio would fall. In this case it would fall to 0.57 ($400,000 / $700,000).

You can also find these results using a ratio calculator.

How is the Debt-to-Equity Ratio Used?

The debt-to-equity ratio is primarily used by companies to determine its riskiness. If a company has a high D/E ratio, it will most likely want to issue equity as opposed to debt during its next round of funding. If it issues additional debt, it will further increase the level of risk in the company.

If a bank is deciding to give this company a loan, it will see this high D/E ratio and will only offer debt with a higher interest rate in order to be compensated for the risk. The interest payments will be higher on this new round of debt and may get to the point where the business isn’t making enough profit to cover its interest payments.

So, a company with high levels of debt will want to issue equity. The business owners will have to give up a portion of the business, but this allows it to bring cash into the business without increasing its interest payments or debt.

On the other hand, a company with a very low D/E ratio should consider issuing debt if it needs additional cash. This business is seen as safer and better able to pay back its loan.

The bank will see it as having less risk and therefore will issue the loan with a lower interest rate. This company can then take advantage of its low D/E ratio and get a better rate than if it had a high D/E ratio.

Frequently Asked Questions

Does the D/E ratio account for inflation?

The D/E ratio does not account for inflation, or moreover, inflation does not affect this equation. Inflation does not change a company’s total debt or total equity.

What does a negative D/E ratio mean?

A negative D/E ratio means that a company has negative equity, or that its liabilities exceed its total assets. A company with a negative D/E ratio is considered to be very risky and could potentially be at risk for bankruptcy.

Does debt to equity include all liabilities?

The D/E ratio includes all liabilities except for a company’s current operating liabilities, such as accounts payable, deferred revenue, and accrued liabilities. These are excluded from the D/E ratio because they are not liabilities due to financing activities and are typically short term.

References

- Corporate Finance Institute, Debt vs Equity Financing, 2022, May 4, https://corporatefinanceinstitute.com/resources/commercial-lending/debt-vs-equity/

- Gallo, G., A Refresher on Debt-to-Equity Ratio, Harvard Business Review, July 13, 2015, https://hbr.org/2015/07/a-refresher-on-debt-to-equity-ratio