Margin Calculator

Use the margin calculator to calculate the gross profit margin, profit, and markup. Enter any two fields to solve the remaining fields.

Results:

| Gross Margin: | 50%

|

| Profit: | $100.00

|

| Markup: | 100%

|

On this page:

- Calculator

- How to Calculate Profit Margin

- What is Profit Margin?

- Gross Profit Margin Formula

- Gross Profit Formula

- Markup Formula

- Different Types of Profit Margin

- How to Choose the Profit Margin You Need to Use

- Why is Calculating Profit Margins Important?

- Limitations of Calculating Profit Margins

- Utilizing Profit Margins: Everything You Need to Know

How to Calculate Profit Margin

There are many different metrics that business owners will use in order to determine whether or not their business is profitable.

One of the most common metrics is profit margin, which indicates how much a business can expect to earn for each additional dollar in revenue that it accumulates.

When a business has a higher profit margin, that means it will accumulate a larger net income with each additional unit that it sells. In other words, the profit margin is determined on a marginal basis.

So, when all else is equal, a business that has a 10% profit margin will generate $2.00 in profit whenever it sells a $20 item, while a business with a 5% profit margin would only generate a $1.00 profit upon selling the exact same item.

In the end, this means that a higher profit margin is a goal that all business owners should be pursuing.

Of course, in the increasingly complex and dynamic world of business, pursuing a higher profit margin is often much easier said than done. Nevertheless, understanding what “profit margin” means exactly, and knowing how to calculate it is critical in business.

In this guide, we will discuss what you need to know about calculating profit margin, including what it is, the formulas you need to know, and how it can be applied throughout the business world.

What is Profit Margin?

The term “profit margin” can be used somewhat broadly, so whenever you hear this term, it is important to clarify what, exactly, is being expressed to you. However, in general, “profit margin” is used to describe how a given business’s revenues are related to its profits.

In most cases, all businesses will want to pursue the highest profit margin they possibly can.

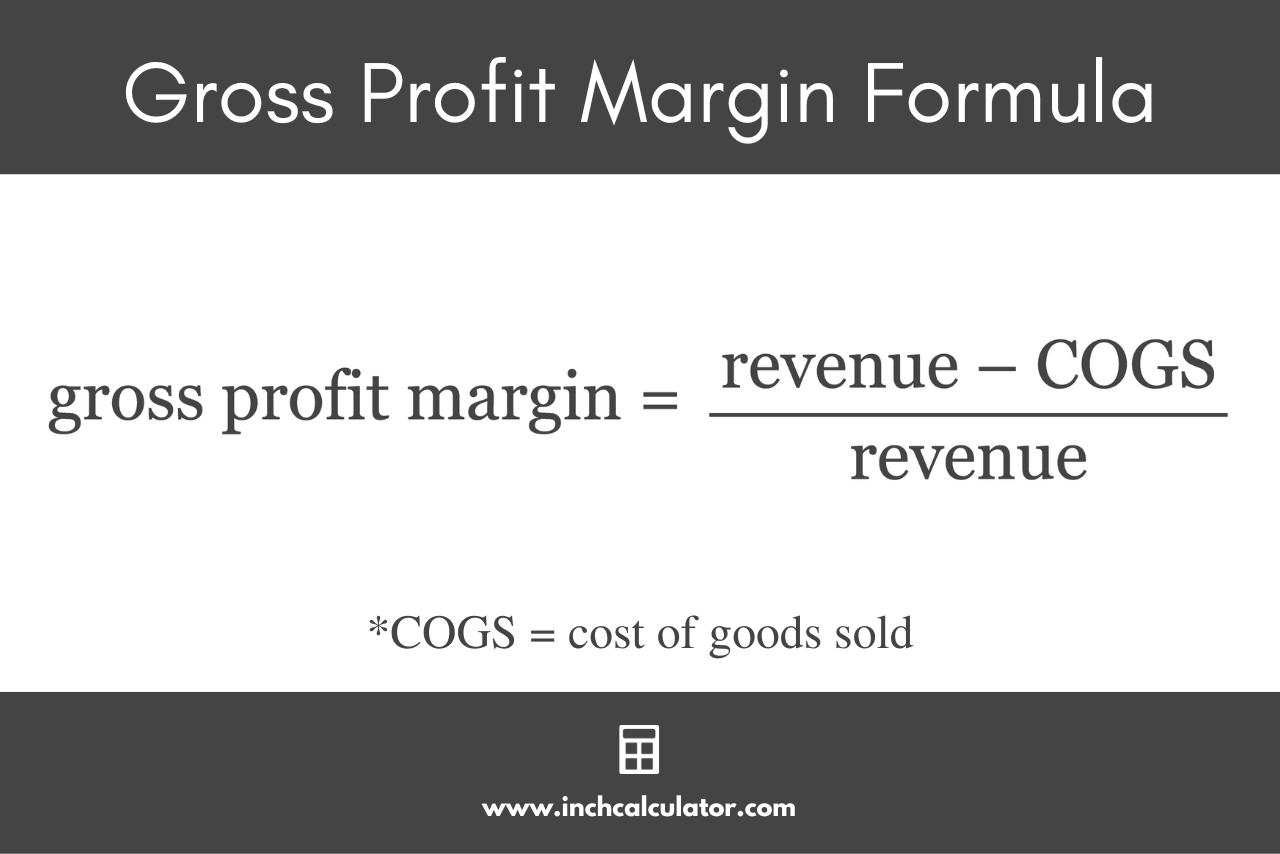

Gross Profit Margin Formula

When people use the term “profit margin”, they are often referring to their gross profit margin. This specific figure will represent a company’s total revenue minus corresponding costs divided by the original revenue figure:

gross profit margin = revenue – COGS / revenue

Thus, the gross profit margin is equal to the gross profit (revenue minus the cost of goods sold) divided by the revenue.

Gross Profit Formula

We used the term gross profit in the margin formula, the formula for it is:

gross profit = revenue – COGS

So, gross profit is simply the revenue minus the cost of goods sold.

Markup Formula

Markup is similar to margin, but the formula is slightly different:

markup = revenue – COGS / COGS

The markup is equal to the gross profit (revenue minus the cost of goods sold) divided by the cost.

For example, using the formula for gross profit margin, suppose a company has $3,000 in total revenue along with $2,000 in total costs. After plugging these figures into the gross profit margin formula (($3,000 – $2,000) ÷ $3,000), you will get a final profit margin of 33.3%.

This means that, on average, for every additional dollar that this company spends on expenses, they can expect to generate about $1.33 in revenue (in total, they will have earned an additional $0.33).

While looking at a company’s gross profit margin will not always paint a full picture of the company’s underlying financial situation, it can certainly be quite helpful.

If a company’s profit margin is increasing, that often means they are moving in a positive direction. But if a company’s profit margin is decreasing, that means some changes might need to be made in the near future.

In order to contextualize the validity of any gross profit margin figures, it is important for a company to compare itself to its competitors.

This will help determine whether a company is outperforming or underperforming relative to its competition and will also make it easier to determine whether a given company’s business model is genuinely sustainable.

Different Types of Profit Margin

Because the term “profit margin” is used somewhat broadly throughout the business community, the term itself can be rather confusing.

But regardless of the specific formula that is being used, the term profit margin almost always refers to the amount of money that a business has earned relative to the amount of money that it has spent on various costs.

- Gross Profit Formula: revenue – COGS

- Gross Profit Margin Formula: (revenue – COGS) ÷ revenue

- Net Profit Margin Formula: (revenue – COGS – expenses – interest – taxes) ÷ revenue

- Markup Formula: (revenue ÷ COGS) ÷ COGS

Let’s calculate each of these for the example company above, which had $3,000 in total revenue and a cost of goods sold at $2,000. We can assume the company had additional expenses of $500, including interest and taxes paid.

Gross Profit Margin: ($3,000 – $2,000) ÷ $3,000 = 0.333 = 33.3%

Net Profit Margin: ($3,000 – $2,000 – $500) ÷ $3,000 = 0.167 = 16.7%

Markup: ($3,000 – $2,000) ÷ $2,000 = 0.5 = 50%

As you can see, there are several different ways to calculate profit margin. This broad term can be used to describe several different variations of financial calculations. However, regardless of the type of profit margin you are calculating, there are a few factors that are universally clear:

- Increasing revenue will increase profit margins as long as costs are not increasing at the same, or even a higher, rate.

- Decreasing costs will increase profit margins as long as revenues are not decreasing at the same, or even higher, rate.

- Profit margins remain a core component of many different types of businesses.

How to Choose the Profit Margin You Need to Use

Three of the most common interpretations of the phrase profit margin include gross profit, gross profit margin, net profit margin, and markup.

Depending on the current goals and finances of your business, each of these formulas can be very useful:

- Gross Profit: This formula is great for businesses that are hoping to expand and generate a positive bottom line. However, gross profit can be easily misinterpreted—it is possible for a business to have a positive gross profit while also generating a negative net profit. Though gross profit only presents a snapshot of your business, it can be useful when trying to determine whether a business is ready to expand. High revenues and limited expenses will typically result in long-term growth.

- Gross Profit Margin: This formula is generally considered even more useful than gross profit because it accounts for how your costs affect your relative expenses. Accounting for total costs relative to total revenue, is very important. Businesses with higher gross profit margins will almost always outperform their counterparts.

- Net Profit Margin: This metric is perhaps the most comprehensive of them all. All companies who hope to improve their bottom line will need to maximize their net profit margin. This is yet another revenue-focused business metric.

- Markup: When a product is “marked up”, the original producer is selling the product for more than they initially paid for it. The markup formula represents just how much the producer values and can capitalize on its initial contributions.

- ROI: ROI, or return on investment, is similar to markup – it’s the ratio of the profit or markup to the investment, but expressed as a percentage.

In order to get a better understanding of their current financial situation, many businesses will examine each of the financial metrics discussed above. Having access to a wider set of data makes it considerably easier to make quantitatively justified financial decisions.

Why is Calculating Profit Margins Important?

One of the most important reasons that businesses of all kinds calculate profit margins is that it makes it much easier for them to compare themselves to other businesses.

By comparing oneself to similarly structured and sized organizations, business owners can develop more accurate expectations and also create more accurate cash flow estimates.

If two businesses within the same industry have 5% and 25% profit margins, for example, it might appear that these two businesses are direct competitors, but their corresponding operating structures will be much different.

Assuming the industry is fairly uniform, it will become clear that the company with 5% margins will need to make a few changes. In the end, sustaining high profit margins will be crucial for almost any business’s long-term survival.

Limitations of Calculating Profit Margins

Of course, as you will encounter with just about any widely-used business metric, all forms of profit margin calculations will have their fair share of limitations. If a business only looks at profit margins—rather than looking at a wider range of metrics—it will be easy for this business to be misled.

Profit margins help reveal the ratio of a business’s revenue to the amount of money that is spent in order to generate that revenue. But that’s it.

Any business that solely looks at its profit margins will end up leaving a significant portion of data uncovered, which could directly affect the amount of actual money the business ends up earning.

We encourage all business owners to take a close look at their profit margins, including the three types mentioned above. But in addition to profit margins, variables such as marginal costs, employee happiness, growth rate, commission rates, and various other factors should also be considered.

Utilizing Profit Margins: Everything You Need to Know

In its simplest form, a company’s profit margin represents how much greater its revenue is relative to its expenses—having a higher profit margin will almost always be in any given company’s best interest.

However, sometimes, the profit margin formula can get a little bit more complicated, and it will be important to understand exactly what the “profit margin” means and any resulting complications.

Another important consideration when evaluating profit margin is the implicit cost. The margin formulas above include explicit costs, but fail to factor in the opportunity costs involved.

For example, if you own and work at a hair salon and generate revenues of $200,000 per year and costs of $180,000 (all costs, not just COGS), your profit is $20,000 a year.

However, if you had the opportunity to work in another capacity and earn $60,000, then you actually have a $40,000 loss from being at the hair salon. In other words, the implicit cost (i.e., opportunity cost) should be considered when assessing the health of the business.